- Written:

- Author: Edward

- Posted in: News

- Tags: $100 bill, bailout, Dr. Ed Park, economics, federal funds rate, gold, imf, keynesian, larry sommers, NDB, negative interest rates, oil, portuguese banks, SDR, yellen

The people who control the Treasury, Fed, banking, investing, commodities, and the policy-making think tanks appear to be bracing themselves for something big. What are the signs?

The people who control the Treasury, Fed, banking, investing, commodities, and the policy-making think tanks appear to be bracing themselves for something big. What are the signs?

Angela Merkel named Time Magazine‘s person of the year (for helping prevent Grexit after adopting Fed-style elastic monetary policy)

No open hostility to cryptocurrency by bankers

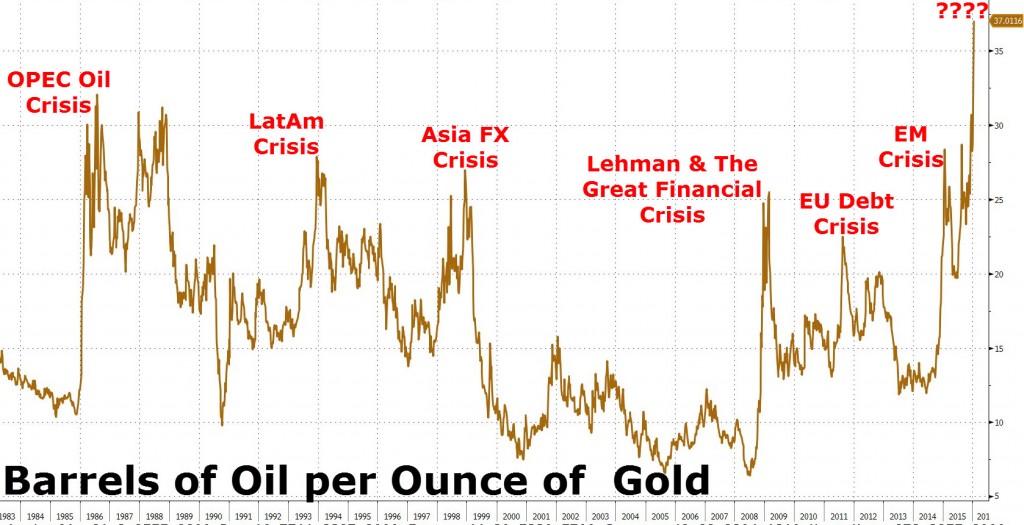

Gold to Oil price at historical high (despite active manipulation)

Freshman, ex-Goldman Fed Commission Kashkari floats the idea of the break up of the big banks (after Sheila Blair’s FDIC helped them gobble up all the solvent small ones).

Like the breakup of big oil and MaBell, this will create better shareholder value and disguise the risk of institutional failure if multiple asset classes go south simultaneously, like student loan debt, equities, consumer loans, and even arms contracts.

No open hostility for inclusion of the Chinese Yuan into the IMF SDR’s definition of money

Portuguese bail-in of bad banks by dilution of shareholders with bad bonds

I am not a student of economics but I do vaguely sense that the lords of finance learned to drive cars on icy roads without breaks or steering, just the accelerator. That is to say, they cannot envision any world in which the velocity of money and quantitative easing (free money) won’t solve all problems. The problem with the Keynesian supply-side economics is that it just doesn’t make sense unless you can guarantee friends with political power will bail you out (as in the 2008 AIG crisis, Savings and Loans Crisis, etc…)

If you artificially intervene in markets to keep the prices high, you are subscribing to a Ponzi scheme and ‘greater fool’ theory. The problem with artificially supporting markets, whether it be the Fed funds rate, or the Chinese equities market is that eventually you run out of buyers. Likewise, when artificially depressing markets, like gold futures , you run out of sellers.

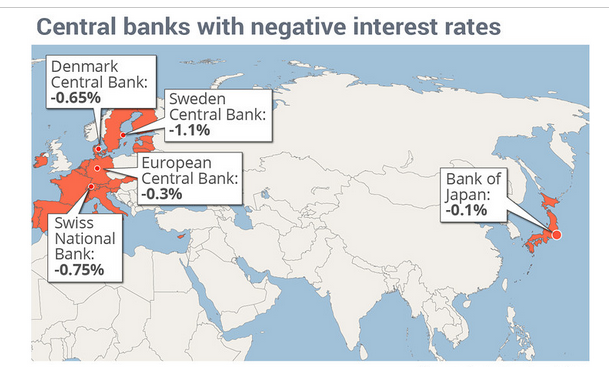

The strange Black Swan event of 36 barrels of oil per ounce of gold is partially an artifact of geopolitical  pressure upon the Petroleum-based economy of Russia. But did anyone note that after a previously sanguine assessment of the economy and a raise in the Fed Funds Rate, that Fed Commissioner Janet Yellen’s seems gloomier and actually threatened us with Negative Interest Rates.

pressure upon the Petroleum-based economy of Russia. But did anyone note that after a previously sanguine assessment of the economy and a raise in the Fed Funds Rate, that Fed Commissioner Janet Yellen’s seems gloomier and actually threatened us with Negative Interest Rates.

It’s like they didn’t slow down or learn to use the breaks, they are just going to “punch it” and steer into the skid to avoid the oncoming 18-wheeler.

So what are my predictions based on the above tea-leaves?

It appears that all forms of money, gold and cash, will be harder to own and store, rendering all wealth to be stored virtually and therefore be subject to more elasticity and creative dilution, as with quantitative easing or stakeholder dilution Portugal.

In their perverse Keynesian pump-priming mindset, they may attempt to combat recession, market corrections, and price deflation that are normal and and the result of free markets and production efficiencies by implementing negative interest rates and lower denominations of bills. This would weaken the strong dollar and the presumption is that if people couldn’t store it in their mattresses they have to spend it on flat screen TV’s and eating out.

With pressures upon markets for equity, real property, and loan portfolios (and the unknown credit default swap risks associated with them), there will be a flight to quality but of course, there will be limited safe havens as currencies of traditionally strong economies will offer negative interest rates and only small denominations.

Large banks will undergo restructuring with majority ownership by the “broken up” parents and then some will be allowed to absorb the risk of failure with others being bailed out by the private sector and public funds.

All forms of wealth accumulation will be virtualized and privatized to the extent that they are solvent and nationalized to the extent that they are insolvent.

Global economic instability in the absence of free markets will create a pretext for adopting a single world currency, negating the recent push of Russian, India, Brazil, China, and South Africa to establish an alternative New Development Bank from the BRICS and non-aligned nations.

I am just a baby-catcher with no training in economics but it appears to me that some people may be scared

based on these weird balloons they are floating… These aren’t conspiracy theorists; these are the Fed Commissioner Janet Yellen, another regional Fed President and Goldman Sachs guy, Neel Nashkari, and the former secretary of the US Treasury and president of Harvard University.

If you ask me (which no one ever has or ever will), I think they should let markets be free and correct and just try to enforce the laws. But everyone seems to want the touchdowns instead of the field goals and they don’t really believe that defense wins.

My key recommendations would be to realize that 1) CDS serve no beneficial function to society and should be unwound and regulated in a controlled fashion, 2) policy makers in every industry can’t always come from the institutions they are charged with regulating, and 3) public funds used to bail out private institutions was once considered ‘moral hazard’ and largesse, not swift, and decisive action in the service of the nation.